Living through a pandemic can feel extremely uncertain and unstable. It is nearly impossible to know how long your life will be impacted and to what degree. There are so many unknown elements to life during a pandemic that you may feel insecure about your future and your finances.

Act Before Things Get Bad

Don’t wait until you are desperate to act. For some, the first inclination may be to wait it out a little to see if the crisis passes, and you can get through it unscathed. However, the longer you wait, the more of a panic you will create. You should consider taking another look at how you manage your money as soon as possible.

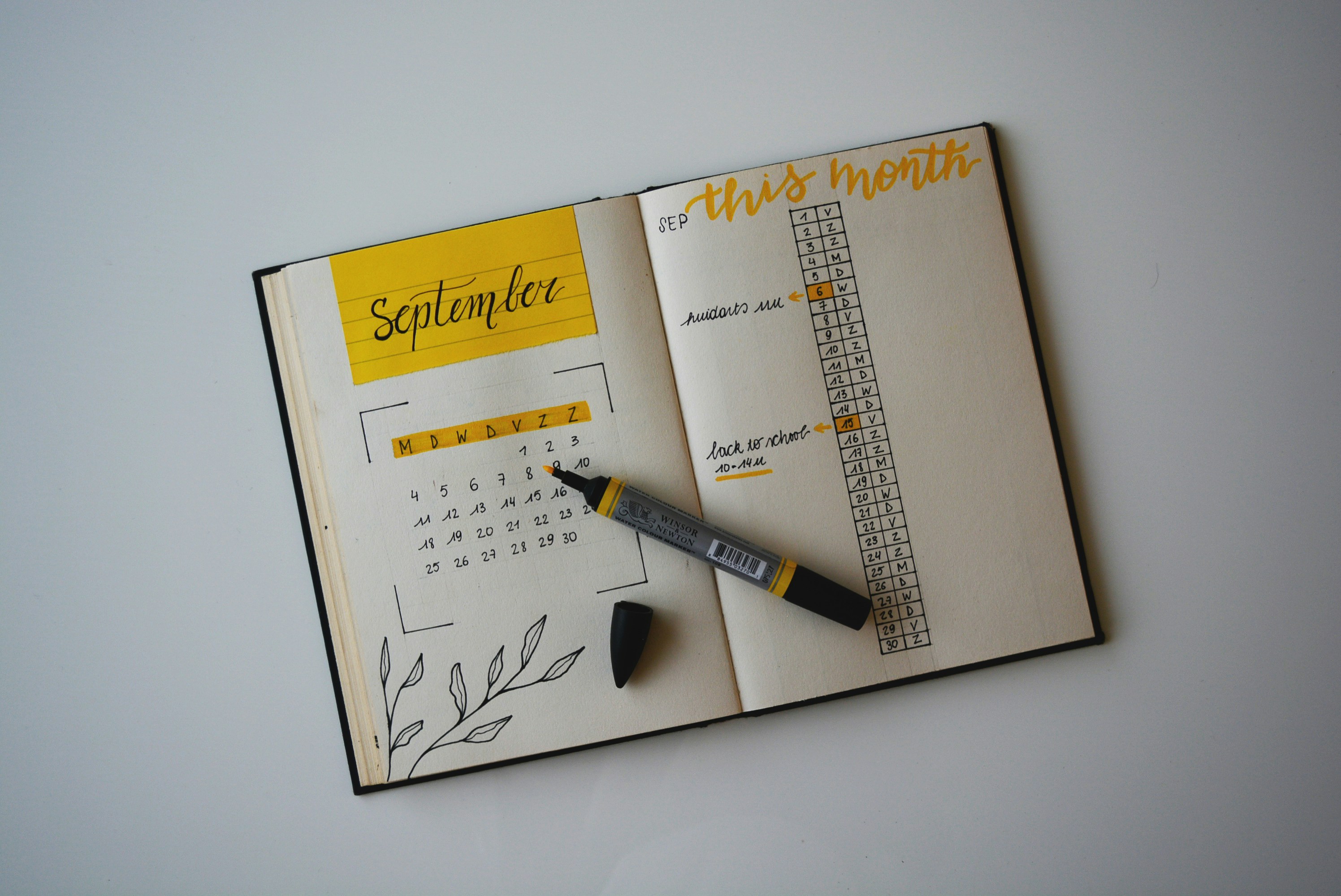

Start by writing out all of your monthly expenses and your income. Writing out your income and expenses will allow you to see exactly how much income you need to cover your essential needs. Once you have everything written down, order your expenses by necessity. For example, your rent or mortgage takes priority over your monthly streaming services. Prioritizing your expenses will help you see what costs you can cut out if you need to.

See a Budget as a Positive Thing

Creating a budget often feels restrictive, as though you are stopping yourself from spending money, but budgets actually can provide you the freedom you need to have some financial peace of mind while you focus on other aspects of your life. Financial expert Dave Ramsey stresses the importance of maintaining a budget in his personal finance program. While Ramsey urges creating an emergency fund before addressing other financial problems, that may not be realistic during a pandemic because you are already facing an emergency.

If you lose part or all of your income due to the pandemic, you should start budgeting by cutting out the expenses that you can live without, at least for now. Once you are down to your essential expenses, contact the companies involved to see if they are willing to work with you. For example, utility companies may offer to suspend shut-offs during a pandemic. Likewise, banks and lenders for mortgages and car payments may allow you to skip up to a pre-determined number of payments due to the situation.

While contacting your lenders to skip payments may seem like the ideal solution to a temporary problem, only take that step if it is an absolute necessity. Additionally, you need to know what the terms of that arrangement are going to be after the crisis is over. For example, will you owe a balloon payment of the skipped payments? Will they be added to the end of the loan, making the total interest higher? Will you have a shortened period to pay back the missed payments? Depending on the terms of the agreement, accepting the deal may actually be more detrimental to your financial state.

Pad Your Income if Possible

If you need to increase the income you have coming in, find ways to supplement your income. While many businesses close during a pandemic, many others not only manage to stay open but are overwhelmed with business. You may be able to get a temporary position with a company that is overloaded with work. You can pick up freelance work by making deliveries or doing personal shopping for people unable to leave their homes. You can look online for work you can do from home.

As long as you can keep making regular payments on all your expenses, it is essential to do so to protect your financial state after the pandemic has passed. Cutting out unnecessary spending will also allow you to save money during turbulent times so that if you do end up losing your job, you will have at least some money in the bank to help you get through.